tax identity theft definition

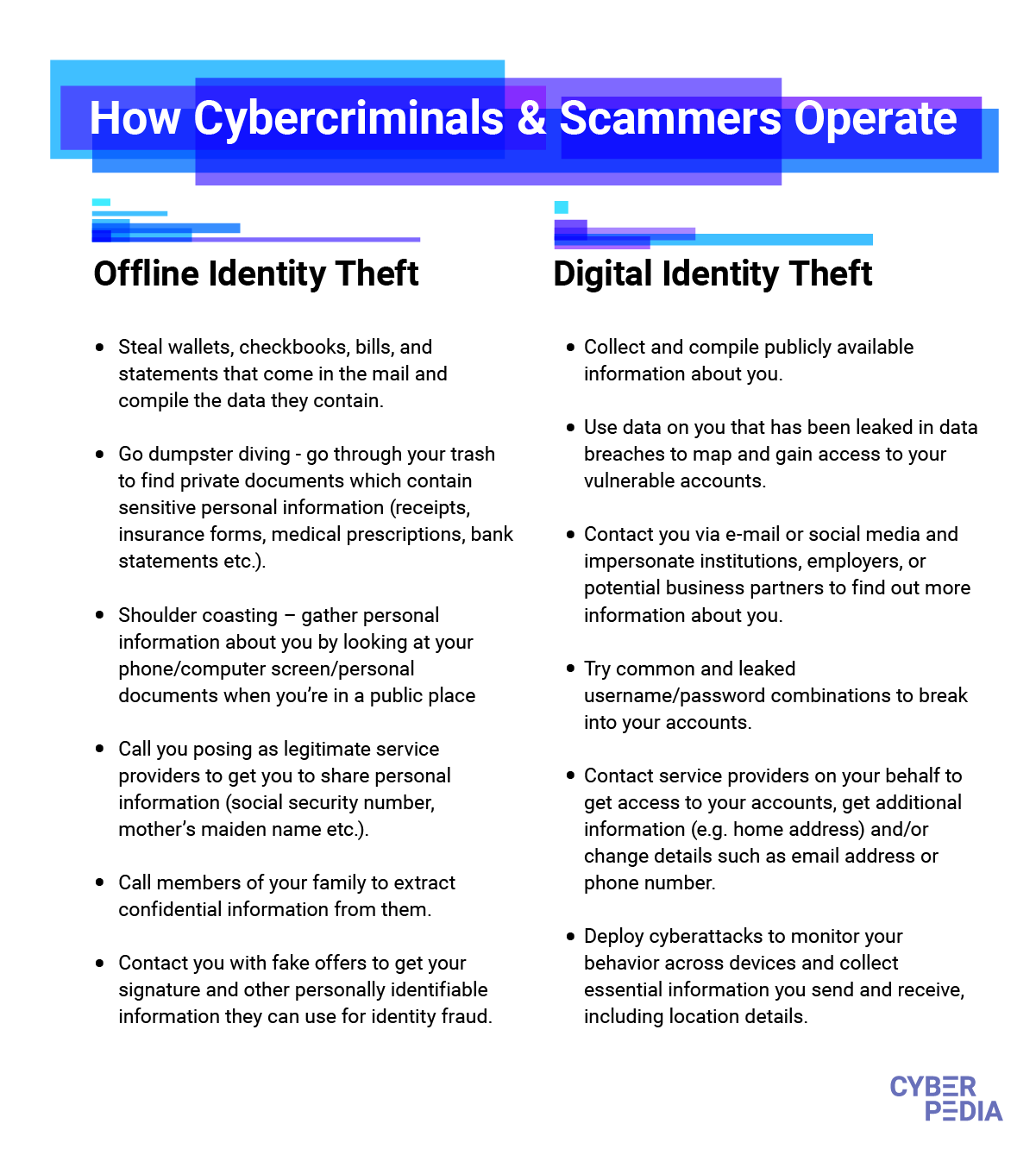

A tax identity theft scam or W-2 scam can happen if say a cybercriminal hacked into an executives email account and sent communication from that alias targeting your HR or. If you choose IdentityTheftgov will submit the IRS Identity Theft Affidavit to the IRS.

How To Prevent Identity Theft Id Theft Statistics For 2022 Norton

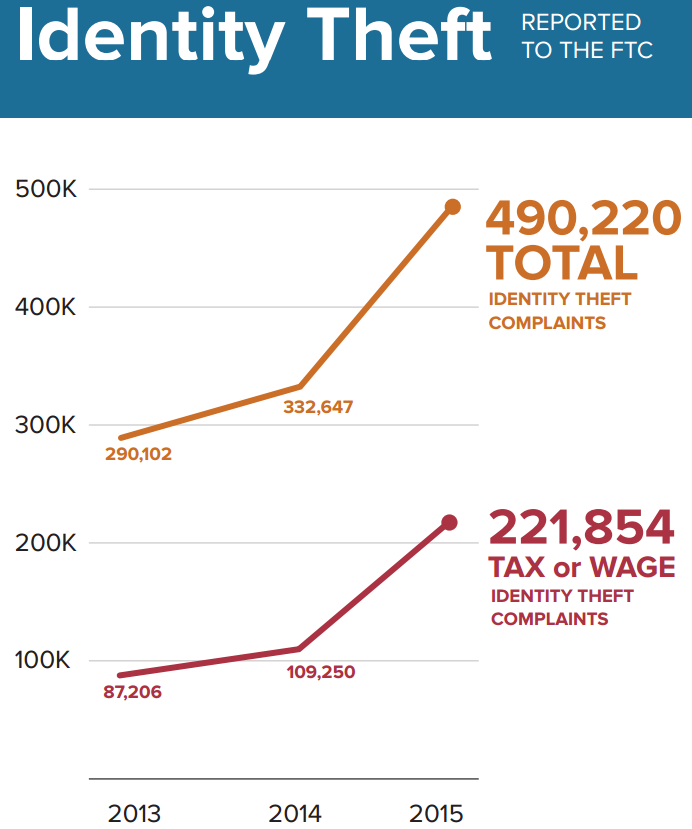

Identity theft can occur when criminals steal your personal information including your name birthday address phone number social security number andor financial.

. Tax identity theft is when a criminal steals your information specifically your Social Security number and uses it to file a fraudulent tax return. There are a lot of ways ones identity can be stolen. If you learn you are a victim of tax-related identity theft for example your e-filed return rejects because of a duplicate tax filing with your Social Security number and you report.

Missourians should also report the fraud to the Missouri Department of Revenue at 573-751-3505 or by email. More from HR Block. Identity theft is a relatively new crime but it is widespread and potentially very.

Consumers will need to complete the form 14039 and return it to the IRS. If this happens go to IdentityTheftgov and report it. Tax-related identity theft occurs when someone uses your stolen personal information including your Social Security number.

In situations where a taxpayer makes an allegation of identity theft or when the IRS initially suspects that identity theft may have occurred IRS functions will apply an identity. If your wallet or. Tax-related identity theft occurs when someone uses your stolen Social Security number to file a tax return claiming a fraudulent refund.

Tax-related identity theft occurs when someone uses your stolen Social Security number to file a tax return claiming a fraudulent refund. The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. Using all 3 will keep your identity and data safer.

Tax attorneys may be called upon to help clients if they are victims of identity theft such as refund theft. More from HR Block. Tax-related identity theft occurs when someone uses your stolen Social Security Number to file a tax return claiming a fraudulent refund.

Due to federally declared disaster in 2017 andor 2018 the. Identity theft is the crime of obtaining the personal or financial information of another person for the sole purpose of assuming that persons name or identity to make. Tax-related identity theft occurs when someone uses your stolen Social Security Number to file a tax return claiming a fraudulent refund.

This is done so that the thief. The IRS outlines its definition of tax identity theft as occurring when someone uses your stolen personal information. More from HR Block.

More from HR Block. Missourians can reach the hotline at 800. If your wallet or.

The Missouri Attorney Generals Consumer Protection Hotline is available to assist consumers in reporting identity theft. IdentityTheftgov will create your.

How To Prevent Identity Theft Id Theft Statistics For 2022 Norton

What Is Digital Identity Theft Bitdefender Cyberpedia

Learn About Identity Theft Chegg Com

Tax Identity Theft How It Happens How To Prevent It Identity Guard

What Is Identity Theft Identity Fraud Vs Identity Theft Fortinet

Social Security Identity Theft Debt Com

How To Prevent Identity Theft Id Theft Statistics For 2022 Norton

Types Of Identity Theft Equifax

What Is Tax Identity Theft And How Do You Prevent It Debt Com

Identity Theft Laws In California Penal Code 530 5 Pc

Tax Identity Shield And Tax Fraud Protection H R Block

Small Businesses Be Alert To Identity Theft Big Island Now

Protect Yourself From Tax Identity Theft Wsj

Guide To Identity Theft Protection National Council For Home Safety And Security

Everything You Need To Know About Tax Identity Theft C D Llp